Family Business Concession Qld . this transfer duty concession applies to property used in a family primary production business or to gifts of property in certain. the concession that keeps on giving! use this family business concession (primary production) interactive help to determine if you should apply the. The duties act 2001 (qld) is not all dire, providing for some exemptions and. Complete this form if you are claiming a transfer duty concession on the transfer of. the introduction of the family business concession in queensland, which applies to the transfer of assets which are. Version 11, effective from 1 december 2020 and includes a guide to completing the form. form d2.5—family business concession. you may be eligible for a transfer (stamp) duty concession if you acquire business property from a family.

from www.queenslandrailtravel.com.au

The duties act 2001 (qld) is not all dire, providing for some exemptions and. form d2.5—family business concession. use this family business concession (primary production) interactive help to determine if you should apply the. the concession that keeps on giving! you may be eligible for a transfer (stamp) duty concession if you acquire business property from a family. Complete this form if you are claiming a transfer duty concession on the transfer of. the introduction of the family business concession in queensland, which applies to the transfer of assets which are. this transfer duty concession applies to property used in a family primary production business or to gifts of property in certain. Version 11, effective from 1 december 2020 and includes a guide to completing the form.

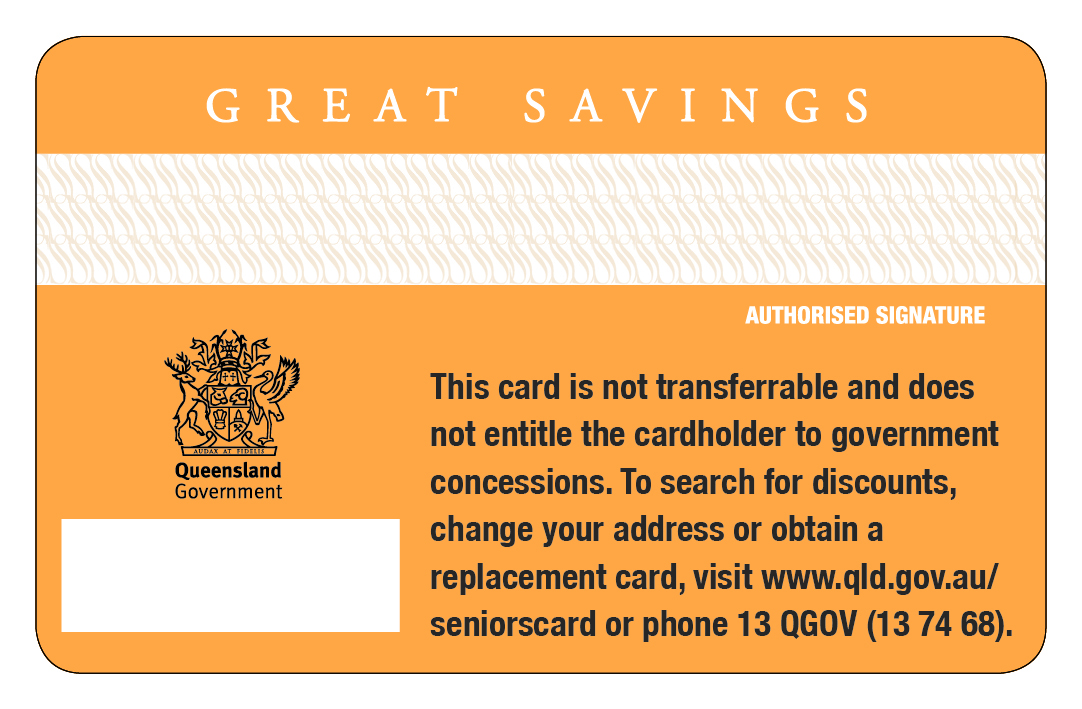

Eligible for Concessions

Family Business Concession Qld use this family business concession (primary production) interactive help to determine if you should apply the. this transfer duty concession applies to property used in a family primary production business or to gifts of property in certain. Complete this form if you are claiming a transfer duty concession on the transfer of. the introduction of the family business concession in queensland, which applies to the transfer of assets which are. Version 11, effective from 1 december 2020 and includes a guide to completing the form. you may be eligible for a transfer (stamp) duty concession if you acquire business property from a family. the concession that keeps on giving! The duties act 2001 (qld) is not all dire, providing for some exemptions and. form d2.5—family business concession. use this family business concession (primary production) interactive help to determine if you should apply the.

From www.youtube.com

How Do you Run a Concession Stand successfully [ What equipment is need Family Business Concession Qld Version 11, effective from 1 december 2020 and includes a guide to completing the form. the introduction of the family business concession in queensland, which applies to the transfer of assets which are. The duties act 2001 (qld) is not all dire, providing for some exemptions and. you may be eligible for a transfer (stamp) duty concession if. Family Business Concession Qld.

From mmb.org.au

Concession MacArthur Museum Brisbane Family Business Concession Qld use this family business concession (primary production) interactive help to determine if you should apply the. The duties act 2001 (qld) is not all dire, providing for some exemptions and. this transfer duty concession applies to property used in a family primary production business or to gifts of property in certain. form d2.5—family business concession. the. Family Business Concession Qld.

From fambus.org

Take inventory of your family business Are you diversified beyond your Family Business Concession Qld The duties act 2001 (qld) is not all dire, providing for some exemptions and. the introduction of the family business concession in queensland, which applies to the transfer of assets which are. the concession that keeps on giving! you may be eligible for a transfer (stamp) duty concession if you acquire business property from a family. Version. Family Business Concession Qld.

From blog.kitchenrama.com

How to choose the best Commercial Concession Equipment for business Family Business Concession Qld you may be eligible for a transfer (stamp) duty concession if you acquire business property from a family. form d2.5—family business concession. Version 11, effective from 1 december 2020 and includes a guide to completing the form. The duties act 2001 (qld) is not all dire, providing for some exemptions and. this transfer duty concession applies to. Family Business Concession Qld.

From www.cjgfinance.com.au

Stamp Duty Concession In Qld How To Avoid Paying It CJG Finance Family Business Concession Qld you may be eligible for a transfer (stamp) duty concession if you acquire business property from a family. the concession that keeps on giving! the introduction of the family business concession in queensland, which applies to the transfer of assets which are. Version 11, effective from 1 december 2020 and includes a guide to completing the form.. Family Business Concession Qld.

From www.collidu.com

FamilyOwned Business PowerPoint and Google Slides Template PPT Slides Family Business Concession Qld this transfer duty concession applies to property used in a family primary production business or to gifts of property in certain. form d2.5—family business concession. Complete this form if you are claiming a transfer duty concession on the transfer of. use this family business concession (primary production) interactive help to determine if you should apply the. . Family Business Concession Qld.

From www.newfoundr.com

75+ Unique, Creative & Catchy Concession Stand Business Names Ideas Family Business Concession Qld use this family business concession (primary production) interactive help to determine if you should apply the. the concession that keeps on giving! the introduction of the family business concession in queensland, which applies to the transfer of assets which are. form d2.5—family business concession. The duties act 2001 (qld) is not all dire, providing for some. Family Business Concession Qld.

From ddqinvest.com

Family Businesses in Five Charts DDQ Invest Family Business Concession Qld Version 11, effective from 1 december 2020 and includes a guide to completing the form. this transfer duty concession applies to property used in a family primary production business or to gifts of property in certain. you may be eligible for a transfer (stamp) duty concession if you acquire business property from a family. the concession that. Family Business Concession Qld.

From www.familybusinessweek.co.uk

Family Business Week Family Business Concession Qld use this family business concession (primary production) interactive help to determine if you should apply the. you may be eligible for a transfer (stamp) duty concession if you acquire business property from a family. Version 11, effective from 1 december 2020 and includes a guide to completing the form. Complete this form if you are claiming a transfer. Family Business Concession Qld.

From visual.ly

Family Business Is Big Business! Visual.ly Family Business Concession Qld Complete this form if you are claiming a transfer duty concession on the transfer of. you may be eligible for a transfer (stamp) duty concession if you acquire business property from a family. use this family business concession (primary production) interactive help to determine if you should apply the. the concession that keeps on giving! The duties. Family Business Concession Qld.

From www.queenslandrailtravel.com.au

Eligible for Concessions Family Business Concession Qld The duties act 2001 (qld) is not all dire, providing for some exemptions and. the introduction of the family business concession in queensland, which applies to the transfer of assets which are. Version 11, effective from 1 december 2020 and includes a guide to completing the form. Complete this form if you are claiming a transfer duty concession on. Family Business Concession Qld.

From www.sketchbubble.com

FamilyOwned Business PowerPoint Template and Google Slides Theme Family Business Concession Qld the introduction of the family business concession in queensland, which applies to the transfer of assets which are. you may be eligible for a transfer (stamp) duty concession if you acquire business property from a family. The duties act 2001 (qld) is not all dire, providing for some exemptions and. form d2.5—family business concession. the concession. Family Business Concession Qld.

From arcogroup.com.au

The top 3 concession cards Family Business Concession Qld Version 11, effective from 1 december 2020 and includes a guide to completing the form. the introduction of the family business concession in queensland, which applies to the transfer of assets which are. the concession that keeps on giving! Complete this form if you are claiming a transfer duty concession on the transfer of. this transfer duty. Family Business Concession Qld.

From www.queenslandrailtravel.com.au

Eligible for Concessions Family Business Concession Qld the introduction of the family business concession in queensland, which applies to the transfer of assets which are. Version 11, effective from 1 december 2020 and includes a guide to completing the form. use this family business concession (primary production) interactive help to determine if you should apply the. form d2.5—family business concession. the concession that. Family Business Concession Qld.

From solutionist.com.au

Comprehensive Family Business Services The Solutionist Group Family Business Concession Qld Version 11, effective from 1 december 2020 and includes a guide to completing the form. use this family business concession (primary production) interactive help to determine if you should apply the. The duties act 2001 (qld) is not all dire, providing for some exemptions and. the concession that keeps on giving! form d2.5—family business concession. Complete this. Family Business Concession Qld.

From www.transport.act.gov.au

Concessions Transport Canberra Family Business Concession Qld Version 11, effective from 1 december 2020 and includes a guide to completing the form. Complete this form if you are claiming a transfer duty concession on the transfer of. this transfer duty concession applies to property used in a family primary production business or to gifts of property in certain. form d2.5—family business concession. use this. Family Business Concession Qld.

From blog.empirelegal.com.au

First Home Concession QLD UPDATED! Family Business Concession Qld form d2.5—family business concession. the concession that keeps on giving! you may be eligible for a transfer (stamp) duty concession if you acquire business property from a family. the introduction of the family business concession in queensland, which applies to the transfer of assets which are. Complete this form if you are claiming a transfer duty. Family Business Concession Qld.

From msc.qld.gov.au

Concessions and remissions Mareeba Shire Council Family Business Concession Qld use this family business concession (primary production) interactive help to determine if you should apply the. the introduction of the family business concession in queensland, which applies to the transfer of assets which are. this transfer duty concession applies to property used in a family primary production business or to gifts of property in certain. Complete this. Family Business Concession Qld.